Colleges do a poor job explaining what comprises the cost of attending the university.

Think about it, we know that we pay for faculty, room materials and the occasional construction project on campus. However, there are hundreds of dollars taken out of our pockets every year going towards mysterious charges that most of us have never heard of.

Books, academic workshops and health services are common things that come to mind when thinking about paying for college. But what other components make up for the $3,500 we have to dish out every semester?

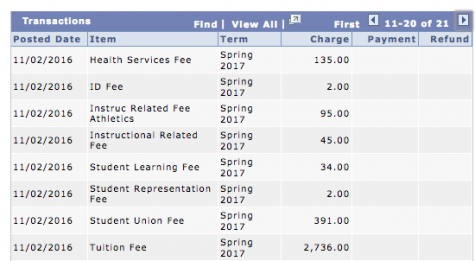

If you look closely at the payment study on your service center, you will find fees for an ‘AS Student fee,’ ‘instructional related fee’ and a ‘student learning fee.’ Isn’t tuition defined as one vast ‘student learning fee?’

Only a few of these expenses are explained in a difficult to find document on the Chico State’s website. When you subtract the fee labeled ‘tuition,’ these expenses equal $786. That could pay a month’s rent in Chico with plenty of money left over to buy food that isn’t boxed mac and cheese.

The price of higher education has skyrocketed within the past 40 years because of inflation and increasing costs. While most of this increase can be blamed on the economy, the other costs that aren’t being explained are crippling students financially.

Even the UC system is beginning to increase their costs after remaining consistent for the last six years. With students paying more every year for tuition, it creates a problem for those who are struggling to pay their own way through school.

It’s likely CSU students will face another tuition increase in the fall.

Furthermore, Chico State is one of the few CSU’s that actually charges students a fee to graduate. This is separate from renting caps and gowns and lodging.

Not to mention, every student paying tuition spends an amount on the WREC every semester. Why isn’t there an option for students who choose not to utilize the WREC.

For some students, the somewhat miscellaneous charges are irrelevant because tuition is paid by their parents. But for students who have to come up with money for school on their own, the growing price tag on their education looms large.

The scary thing is tuition may increase while a student is in the process of earning their degree. This being said, we should know exactly what we are paying for. It should be clear that our scholarship money isn’t going to some strange ‘student representation fee.’

Although some people might not worry about where the $3,500 they pay every five months goes, the students who live on ramen and occasionally sleep in their cars do worry.

Although I am near the end of my college career, these expenses are going to follow me long after I am my diploma. One of my biggest fears is that I will be living with my parents until I’m 45 because I am still paying off students loans.

If higher education is as crucial to our success, then students need to be reassured they are getting the most bang for their buck. Unfortunately, I am already questioning if this was all even worth the price tag.

Nicole Henson can be reached at [email protected] or @nicohenson on Twitter.

Arturo V. // Feb 3, 2017 at 3:04 pm

Most have fees for stuff like cap and gown but not the actual fee to just walk. This place scams. I swear

Sue Anderson // Feb 1, 2017 at 5:27 pm

The info on commencement fee is incorrect. Most, if not all, CSU’s have a fee for commencement.