Audit finds hospitality expense policy could use improvements

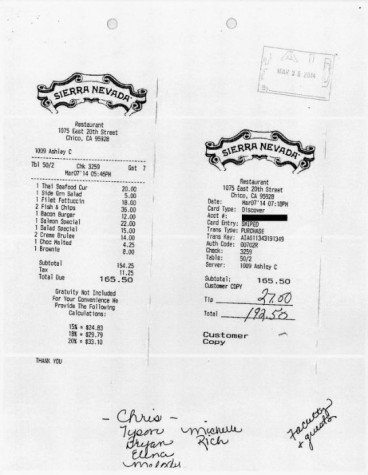

Department chairs spent over $600 on hospitality meals. Document obtained by a public records request.

A Chico State employee was reimbursed $1,215.48 for meals she attended, approved and “directly benefited from,” violating the Foundation Hospitality Expense Policy, according to a California State University audit.

The audit also noted that, although the policy doesn’t set a dollar limit per meal, meals purchased with a University Foundation procurement card by a different employee were “well over the campus hospitality meal limits.”

Some of the eateries included Tres Hombres, Sierra Nevada Taproom and Restaurant, Franky’s Pizzeria and 5th Street Steakhouse, where seven bottles of wine were purchased over 10 days and three visits costing $336.

Documents related to these expenses, including receipts and emails, were obtained by The Orion through a California Public Records Act request.

Melody Stapleton and Curt Haselton, who were both department chairs during the period audited, each said the meals were for faculty members and candidates being interviewed for tenure-track positions in the College of Engineering, Computer Science and Construction Management.

Stapleton, chair for the computer science department, said she paid for the meals totaling $1,215.48 and the University Foundation reimbursed the expenses. Haselton, civil engineering’s former department chair, approved expensive meals he attended, which were separate from Stapleton’s, according to Chico State records.

“Individuals with delegated approval authority may not approve their own expenses and individuals may not approve expenses of their supervisor,” states one section of the hospitality policy for the University and Research foundations.

The audit covered the College of ECC from Jan. 1, 2013 to May 15, 2015, and its findings were delivered to President Paul Zingg on Aug. 3. The audit reported no “significant internal control problems” were revealed but discovered there was room for improvement. Auditors recommended campus leaders remind employees about the policy and “determine whether a dollar limit should be imposed for certain expense categories, such as meals.”

As a result, the foundation hospitality policy was revised. As of Dec. 1, 2015, the policy includes a maximum per-person rate for meal expenses: $25 for breakfast, $30 for lunch, $60 for dinner and $20 for light refreshments.

Catherine Thoma, executive director of the Research Foundation, approved the reimbursement for Stapleton by signing a check request form.

Thoma said she could have prevented the “oversight” if only she had been more careful, and Stapleton shouldn’t have signed the form because it was against the policy. Someone else, such as a dean, should have signed where Stapleton did, Thoma said.

“We have what’s called a ‘one up,'” she said.

The director said the “one up” system means only higher-ranking employees are allowed to approve the expenses of lower-ranking employees.

Stapleton agreed, although she was unaware of the policy before the audit.

“It’s never been an issue before, but then again I don’t think our college has ever been audited. It’s a procedure we were unaware of,” said Stapleton, who’s been the department chair for about four years.

Stapleton also said she has yet to read the audit or the policy since its revision, but was going to ask if the computer science administrative support coordinator, Michelle Berglund-Smith, understands the procedure.

Berglund-Smith said she does.

Haselton, who is currently on sabbatical, said he disagrees with the auditors’ assessment that the meals were excessive.

“If I agreed with that, I wouldn’t have spent the money… We’re trying to hire someone who could be here for 30 years, and if we need to spend a little money to take them to a nice dinner so they have a good impression of Chico State, that’s what we do,” Haselton said in a phone interview.

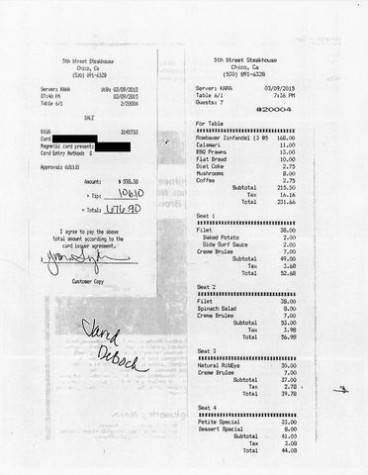

Receipts obtained show three of his department’s meal expenses, and a bank statement shows four more, but none of them have itemized receipts on file.

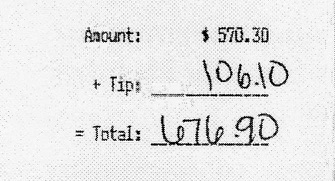

One dinner at 5th Street Steakhouse with six guests cost $465. Another outing there with seven guests cost $676.90.

It is unclear who actually attended the dinners because the receipts, which should bear the names of attendees, don’t list them, Thoma said.

The audit notes this as well, stating: “Proper approval and documentation of expenses improves accountability, allows appropriate administration of funds, and decreases the risk of noncompliance with CSU and governmental requirements.”

Haselton said the dinners were justified because an assistant professor, Jared Debock, was hired for his department. Stapleton said her department’s expenses helped to hire Kevin Buffardi, who is now a computer science assistant professor.

On Feb. 18 Stapleton said in an unsolicited email that she donates $1,500 per year to her department because she’s a member of the “Tower Society,” though she did not specify which one or how many times she’s donated.

“Seems to me that I paid for those meals, even if indirectly,” she said.

When asked if she benefited from the donations, possibly in the form of a tax deduction, she challenged the question’s relevance.

“Is this story about me or the ECC audit? I’m not sure how your questions are relevant to the ECC audit?” her email read.

Thoma said reimbursements for meals and alcoholic beverages are actually OK, according to foundation policy, despite Chico State’s history as a party school.

Over decades, Chico State built a national reputation for off-campus parties where many students abused alcohol and some even died.

Thoma also said the University Foundation does not comprise “taxpayer dollars.” Funds come from private donations, she said.

On Feb. 17, when Stapleton was interviewed in her office, the department chair said the university has lots of policies and procedures and now that she’s aware of the Foundation Hospitality Expense Policy, she will follow it.

“I guess that’s the purpose of audits,” she said, “to familiarize people with the rules.”

Gabriel Sandoval can be reached at [email protected] or@GLuisSandoval on Twitter.