It’s finally the weekend. Classmates are getting the rest of their school supplies, friends want to go shopping and later they are going out to the bars. There are so many things to do but the bank account is saying otherwise.

College students often find themselves having a difficult time buying their necessities. Courses are difficult, but budgeting can sometimes be even harder.

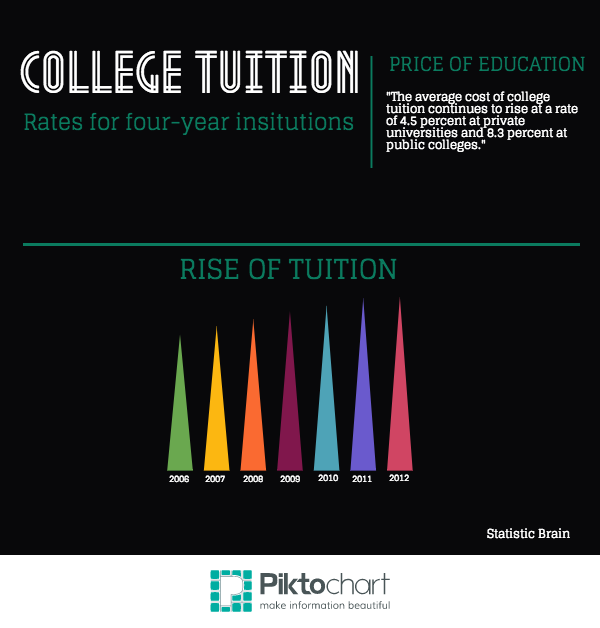

The cost for a college degree has significantly increased over the last decade. Tuition and residence hall rates for the average public four-year college institution has increased by $9,339 from 2001 to 2013, according to statistic brain. The rate jumped from $12,922 up to $22,261.

“It’s astonishing that the price of education continues to rise,” said Patricia Wong, parent of Chico State students Tyler and Christina Wong. “It seems almost unfair that us parents are being buried in debt for providing our children with something completely necessary and critical for their future success and ability to one day support their own family.”

Even with possible scholarships and financial aid, college expenses are extremely pricey. It is difficult to plan for purchasing books, supplies, food, household necessities, transportation and entertainment, not to mention all while balancing a class schedule and homework.

Returning students usually learn from their prior experience and are able to save and create a steady plan to manage their school and extracurricular finances.

Jake Sanfilippo, senior business marketing major, reflects back on his first year here at Chico.

“I was that typical starving student on that top ramen diet,” Sanfilippo said. “Most my money went towards going out on the weekend so I usually forgot about saving enough for food. I’m a senior now and I’ve finally learned to pay attention to prices when I grocery shop and set money aside for the other stuff I want.”

Figuring out a budget method that works best is something that takes some extra effort, but don’t stress about spending, start saving.

A lot of students don’t realize there are practical, everyday alternatives for a happy, longer-lasting college budget.

Miranda Robinson, data analyst in the Financial Aid & Scholarship Office, offered helpful tips on how to make your college budget last longer.

1. Rent, don’t buy.

Textbooks are a necessity for most college courses. Cut costs on reading materials by renting used editions in advance from Amazon.com.

2. Use meal deals.

Grocery shopping is not only more healthy, but also a lot more cost-effective than eating out at restaurants or fast food.

3. Rent with roomies.

Living downtown in an apartment or house is cheaper than living in the dorms. There are often advertisements online and on Craiglist for people looking to fill rooms. University Food and Housing on campus also offers alternatives for on or off-campus housing.

4. Look on Facebook.

The Chico State class pages on Facebook are often used as a market for selling, buying and trading. People post clothes, rooms, furniture, pets, books, concert tickets, rides and much more on the page. Bargaining with classmates on this page could seriously cut costs and help save a little extra cash.

5. Find new transportation.

Swap paying for gas and parking passes by using Butte County’s B-Line bus system. The B-Line is 100 percent free for Chico State students and employees with their Wildcat Cards.

Julie Ramos can be reached at [email protected] or @julie_ramoss on Twitter.