Chico State students replace cash with Venmo

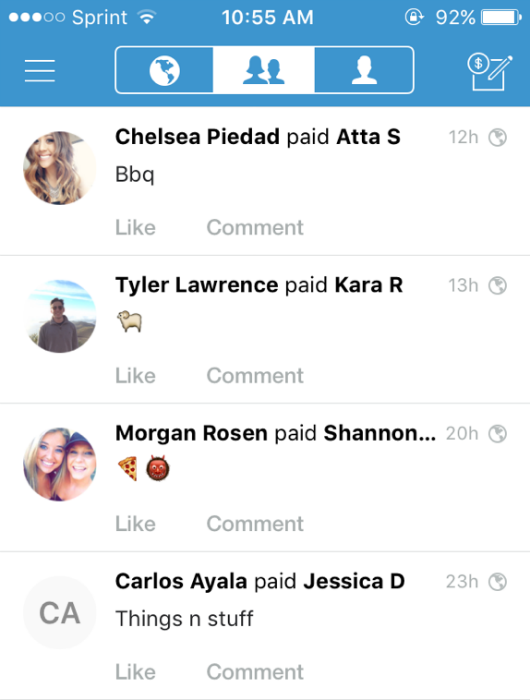

The homepage of Venmo resembles other social media platforms with information on what friends are paying for. Photo courtesy of Tiffany Perriera.

As with physical mail, phonebooks and maps, cash seems to be outdated, thanks to electronic transfer technologies, including the popular Venmo app.

Venmo is a service of PayPal, the powerful alternative to checks and money orders, which had 4.9 billion payments via mobile devices in 2015. While PayPal is used on a global scale mainly for secure purchases from merchants who must pay a fee, Venmo is growing on a more personal peer-to-peer level.

The app is a free service with only four steps to sign up and start using. Like many other apps on the market, this process can be sped up by simply connecting with a Facebook account before inputting card information.

Once the initial set-up is taken care of, users can transfer and receive money on the app without having to enter their card information again. The service has been a helpful alternative to dreaded check-splitting cases at dinner or at places that do not accept cards.

“I’ve used it for situations where I don’t have cash on me, but my friends do, so if we’re at Aca Taco they can just buy my food for me and then I’ll pay them back with Venmo,” said Tiffany Perriera, a sophomore at Chico State.

Contrary to popular belief, Venmo does not actually transfer funds directly from bank account to bank account. The app holds funds in the user’s Venmo account, and the only way to transfer money back into a bank account is by doing so manually in the app.

“I don’t like how when you Venmo someone, (the money) comes out of your bank account, but if someone Venmos you, like you bill them and they pay you money, it goes to your Venmo account,” Perriera explained, “and then you have to push a button to transfer it to your account and it takes three days, so it doesn’t automatically get to you if you want it in your actual bank account.”

Users have had issues with that and other aspects of the app, especially when having transactions with strangers, something that Venmo discourages. The app is not meant for merchant transactions, but rather a secure way to pay friends and acquaintances.

The actual security of the app has been questioned since it is as easy as selecting a contact in the app and entering an amount. Venmo announced last March that it would improve its security features with notifications, alerts and an option to have a pass code to verify transactions.

The usability of Venmo paired with the home page resembling a social media platform seems to make users feel more comfortable with the app.

“It’s interesting that it’s like a social networking app, and you can see what other people are paying for, so I think that’s kind of fun, seeing people interacting,” said Hannah Dutra, Chico State first-year.

Venmo is not the first app of its kind, however. More recently, Snapchat began offering similar services with Snapcash, an advance made possible through a deal with Square, the company best known for giving small businesses an easier way to accept card payments with smartphone swiping devices and tablets (these can be seen mostly at taco trucks, or even Naked Lounge).

Students at Chico State seem to be using Venmo and Snapcash in similar ways: to make money transfers as easily and as quickly as possible.

“I use Snapcash a lot with my boyfriend when we take road trips because it’s so much easier for someone to just pay the hotel costs and all that stuff, then just snap them along the way,” said Hayley Holloman, a senior at Chico State.

Either way, both apps seem to work in similar ways, and other peer-to-peer payment apps are constantly appearing with ranges in costs, time that it takes for cash to deposit and limits on transfer amounts.

Soon enough cash may be the next newspaper in terms of nearly obsolete paper products.

Christine Zuniga can be reached at [email protected] or @kissssteen on Twitter.