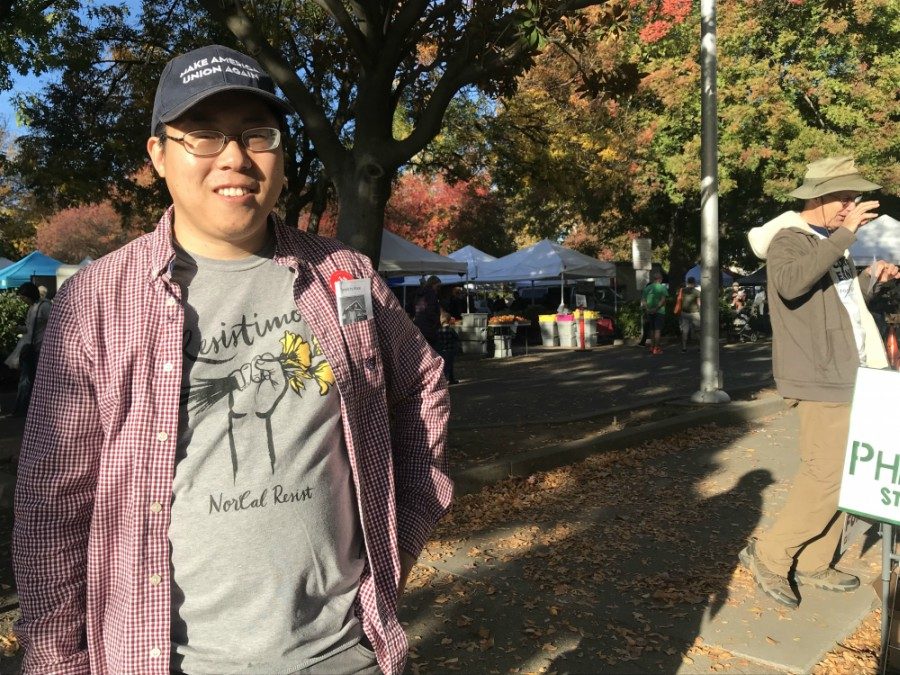

Democratic candidate, Phillip Kim, was finishing up last minute campaigning, on Saturday, at Chico Certified Farmers Market.

Kim is running for the California State Senate for District 4 against incumbent, Jim Nielsen.

On the last weekend before the midterms, he wanted to talk to voters about Medicare for all, banning fracking and the fight for free college tuition.

One of the most important issues to Kim is how expensive housing is in California. It’s part of the reason he’s such a strong advocate of Proposition 10.

“The rent throughout California, not just big cities, is too damn high,” Kim said. “So we have to have a variety of tools to be able to have affordable housing, and rent control is one of those tools.”

Critics of rent control say that, in the long run, it makes housing more expensive and harder for new housing to be built. Kim wants people to look at who’s funding the No side of the Prop 10 campaign.

“It’s largely a group of Wall Street real estate investment companies…,” Kim said. “But I think a lot of what they’re saying doesn’t make sense, because if we give cities the tools for rent control, it prevents rent from being unfairly increased every year.”

One of the common issues of California candidates, and citizens, is the homeless problem. California has the third highest per capita homeless rate, according to the U.S. Department of Housing and Urban Development: The 2017 Annual Homeless Assessment Report (AHAR) to Congress.

“I think the number one cause of homelessness is expensive rent,” Kim said. “So if we can make sure there’s more affordable housing via rent control and also by building more publicly owned housing, then that’s the way to go.”

Voters in California are concerned about the rising health insurance cost. Kim believes this is because the current system is fragmented and profit-driven. He believes by switching to a Medicare for All system, California will be able to guarantee high-quality care and save money. However, according to an analysis done by the Los Angeles Times, this system would cost $400 billion, but Kim has a plan to pay for it.

“Studies have shown Medicare for All would actually save us money,” Kim said. “The taxes we would pay into the system would replace all of our premiums, copays and deductibles, which currently are very expensive.”

If you want to find out more about Phillip Kim, you visit his Facebook page or website.

Justin Jackson can be reached at [email protected], or on Twitter @JustJack0176

Gavin R. Putland // Nov 4, 2018 at 3:48 pm

VACANCY TAX: BETTER THAN RENT CONTROL

(And there are vacancy taxes on the ballot for November 6: Measure T in Richmond (CA), and Measure W in Oakland.)

Rent control doesn’t force owners to offer their properties “to let” at the allowed rent. Nor does it force land owners to build more housing. Indeed it discourages both, reducing the supply of housing and therefore RAISING the rents of whatever part of that supply is not subject to rent control. Exempting NEW buildings from rent control may avoid deterring construction, but it still doesn’t open up EXISTING buildings for tenants. Worse, it means that the stock of rent-controlled housing becomes a shrinking fraction of the whole housing stock — unless the exemption is only for a limited time, in which case you’re discouraging construction again!

Will removing regulatory barriers to construction solve the problem? Not by itself, although it’s obviously a necessary condition. Cheaper housing requires developers, builders, and owners to increase supply to a point where it reduces their return on investment. They obviously won’t do that voluntarily. They will do it only if they are penalized for NOT doing it.

SOLUTION: Put a punitive tax on vacant lots and unoccupied housing, so that the owners can’t afford NOT to build housing and seek tenants. By increasing supply and reducing owners’ ability to tolerate vacancies, a vacancy tax strengthens the bargaining position of tenants and therefore reduces rents (and forces landlords to expedite any necessary repairs in order to attract tenants). It yields both an *immediate* benefit, by pushing existing dwellings onto the rental market, and a *long-term* benefit, by encouraging construction.

Such a tax, by reducing the cost of housing, would make it easier for employers to pay workers enough to live on. A similar tax on commercial property would reduce rents for job-creating enterprises. That’s GOOD FOR BUSINESS and GOOD FOR WORKERS.

A vacancy tax is also GOOD FOR REALTORS because they get more rental-management fees for properties coming onto the rental market, plus commissions from any owners who decided to sell vacant properties to owner-occupants (who of course don’t pay the tax).

Best of all, the need to avoid the vacancy tax would initiate economic activity, which would expand the bases of other taxes, allowing their rates to be reduced, so that the rest of the city/state/country gets a tax cut!

Gavin R. Putland,

grputland.tumblr.com .